Santuario Ra•Ma: Boutique Wellness Villas in La Veleta, Tulum

The Riviera Maya's real estate market stands out as one of the Western Hemisphere's most profitable and dynamic property markets. What makes this coastal paradise particularly attractive for investors is its stability. Unlike markets characterized by volatile growth patterns, the Riviera Maya benefits from consistent year-round demand, supported by robust infrastructure, excellent livability, and diverse visitor profiles. Furthermore, the Mexican Peso has demonstrated remarkable resilience (often termed the 'super peso') relative to the U.S. Dollar, creating a favorable environment for foreign investment.

In this comprehensive guide, we'll explore what potential investors need to know about the Riviera Maya's real estate outlook for 2026, from price trends and high-potential areas to potential risks and opportunities that lie ahead.

Riviera Maya Real Estate in 2026: Price Trends and Market Snapshot

The Riviera Maya property market has evolved into a nuanced landscape where location and property type significantly influence investment outcomes. In 2026, we're seeing distinct patterns emerge across this sought-after Caribbean corridor that savvy investors should understand before making their moves.

Average price per square meter

Across the Riviera Maya, the average price per square meter currently sits at approximately 52,000 MXN (roughly USD $2,900), though this figure varies considerably by property type and location. Condos command higher prices at around 63,000 MXN per m², while houses trend lower at approximately 45,000 MXN per m².

In Playa del Carmen specifically, the median price reaches 60,000 MXN (USD $3,334) per square meter, with the average climbing to 70,000 MXN (USD $3,889) per square meter due to premium beachfront properties pulling the mean upward. The highest prices are found in Playacar and Coco Beach, where buyers can expect to pay between 75,000 to 120,000 MXN per square meter for prime properties. Conversely, more affordable options exist in Ejidal and parts of Colosio, with prices ranging from 25,000 to 45,000 MXN per square meter.

For those considering complete properties rather than price per meter, the current averages in Playa del Carmen are telling. Condos average around USD $324,696, houses reach approximately USD $899,788, and penthouses command about USD $836,847.

Recent 12-month growth rates

The real estate market in Riviera Maya has demonstrated remarkable resilience, with property prices increasing by approximately 7% in nominal terms over the past year (January 2025 to January 2026). However, this growth hasn't been uniform across the region.

Looking at municipal-level data, coastal and tourism-focused areas have significantly outperformed the national average. Benito Juárez (which includes Cancún) posted an impressive 15.16% year-over-year increase, while Solidaridad (including Playa del Carmen) saw a robust 13.61% gain.

Notably, Playa del Carmen property prices have risen about 12% in nominal terms (or roughly 8% after adjusting for Mexican inflation) compared to January 2025. This performance underscores the region's continued appeal despite broader economic fluctuations.

Top-performing property types

Not all property investments in Riviera Maya yield equal returns. As of early 2026, the clear winners in terms of appreciation are:

Villas and detached houses in prime communities - These properties, particularly in established areas like Playacar and Puerto Aventuras, are appreciating at roughly 8-10% annually

Family-sized townhouses - Showing strong, steady growth as the second-best performing category

Well-located two-bedroom condos - Particularly those with proximity to the beach and walkable neighborhoods

The dominance of larger residential properties reflects a shift in buyer preferences toward end-user comfort rather than purely investment-focused studio units, which currently show the lowest appreciation rates.

The upcoming FIFA World Cup 2026 is already influencing property values, especially in Cancún. The city is experiencing sustained growth near the Hotel Zone and in new residential developments, primarily due to airport expansion and improved connectivity via the Maya Train. This mega-event is creating particular upward pressure on high-density luxury condos as investors position themselves to capitalize on the projected visitor influx.

Forecasting 2026: What Experts Predict for the Year Ahead

As the real estate landscape continues to evolve across the Riviera Maya, forecasts for 2026 suggest we're entering a more mature market phase characterized by moderate but consistent growth. Based on current economic indicators and market dynamics, let me break down what experts anticipate for the year ahead.

Expected price growth range

Financial analysts remain cautiously optimistic about the Riviera Maya real estate forecast for 2026. Fitch Ratings projects price growth in the range of 8-9% for the year, a slight moderation from previous cycles but still robust by global standards. Other market watchers offer slightly more conservative estimates, with property prices expected to increase by approximately 6-8% over the full calendar year.

The range of forecasts from different analysts spans from a conservative 5% to a more optimistic 9%, with variations depending on assumptions about interest rates and economic stability. This diversity in projections reflects the increasingly nuanced nature of the market.

Moreover, some long-term scenarios forecast an average annual growth rate of about 4.8% for the residential sector through 2025-2028, which remains solid for a market that has already seen substantial appreciation.

Interest rate impact on buyer demand

Interest rates will play a crucial role in shaping buyer demand throughout 2026. Currently, the average nominal interest rate for fixed-rate mortgages sits at 11.63% (as reported by the central bank in July 2025). According to financial projections, mortgage rates in Mexico are expected to ease to between 10.0% and 11.0% by the end of 2026.

In practical terms, this gradual reduction will meaningfully impact purchasing power. For every 1% drop in mortgage rates, buyer purchasing power typically increases by 8-10%, which generally translates into upward pressure on property prices as more households qualify for larger loans.

The main assumption underlying most price increase forecasts is that Mexico's central bank will continue its cautious easing cycle while tourism remains stable, creating a balanced environment that supports buyer demand without triggering speculation.

Tourism and rental market outlook

The tourism and rental sectors remain fundamental drivers of the Riviera Maya real estate market. Presently, rental inflation has stayed moderate, with the housing component of the Consumer Price Index registering a 3.48% year-on-year growth as of August 2025.

Looking forward, the rental market is projected to expand substantially. The Mexican Chamber of the Construction Industry forecasts that rental housing could account for up to 50% of occupied dwellings within the next two decades, indicating strong long-term rental demand.

For investors, the most stable returns are increasingly found in medium-term rentals (3-12 months) rather than purely vacation rentals, as these provide more consistent cash flow and reduced seasonality. Communities with established residential density and essential services continue to outperform purely speculative zones.

Regarding the FIFA World Cup 2026, its influence extends beyond Cancún to the broader Riviera Maya region. The tournament is already creating upward pressure on property values, with sustained tourism demand acting as the single strongest factor driving prices in the area. As infrastructure improvements progress and visitor projections become clearer, this major sporting event stands as a significant catalyst for continued market strength throughout 2026 and beyond.

Top Areas to Watch for Investment Growth

Knowing where to invest in the Riviera Maya requires a keen understanding of local market dynamics. For 2026, certain areas stand out as particularly promising for savvy real estate investors.

Cancun beach zones: connectivity and visibility from the World Cup

Cancun’s beachfront zones continue to stand out as one of the most resilient and internationally attractive real estate markets in the Riviera Maya. Anchored by Cancún International Airport, the destination offers unmatched connectivity, with direct flights to major cities across the U.S., Canada, Europe, and Latin America. This ease of access has made Cancun a natural choice for second-home buyers, digital nomads, and investors looking to combine lifestyle, rental demand, and long-term appreciation—especially for those escaping colder climates in North America and Europe.

Cancun's beach zones are also gaining exceptional visibility as the city is being considered as a potential site for an official FIFA Fan Fest during the 2026 World Cup. This high-profile event would transform Cancun's beaches into festival grounds, creating a significant boost for surrounding properties. Similar events in past World Cups have generated impressive returns—Moscow's 2018 festival attracted over 3 million attendees and produced approximately $60 million in economic activity.

The approaching World Cup is already influencing the market, with home prices jumping up to 10% in just one year. Furthermore, FIFA has confirmed that certain complexes in the Mexican Caribbean will serve as Team Base Camps for national teams, cementing the region's status as a world-class destination.

Puerto Morelos: value and connectivity

Puerto Morelos represents one of the most compelling value propositions in the Riviera Maya today. Perfectly positioned between Cancún and Playa del Carmen, the town benefits from exceptional connectivity while maintaining a slower, more residential coastal lifestyle that is especially popular with Canadians and Americans. This balance has made Puerto Morelos increasingly attractive to buyers seeking authenticity, space, and long-term upside without the price pressure of more mature markets.

From a pricing standpoint, the opportunity is clear. Average prices hover around $185 USD per square foot, compared to roughly $230–$280 USD in Playa del Carmen. Beachfront condos in Puerto Morelos still start near the $300,000 USD mark, while comparable units just 30 minutes south often exceed $400,000 USD. This gap alone positions the area as a strong candidate for value appreciation as buyer demand continues to spill outward from higher-priced zones.

Beyond the coastline, growth is accelerating inland along the Ruta de los Cenotes, a lush corridor connecting Puerto Morelos to the jungle and cenote systems of the region. This area is quickly becoming the foundation for the next generation of master-planned, nature-integrated communities. Developments such as Xul‑Ha represent early entry points into what many expect will be fully established residential ecosystems over the next 3 to 5 years—offering privacy, larger lots, sustainability-focused design, and a strong sense of community.

Gated communities in Playa del Carmen: rising relocation

Playa del Carmen is experiencing a notable shift in demand within its gated communities. While short-term rentals once dominated investor conversations, the market is increasingly being driven by buyers seeking second homes, long-term relocation, and lifestyle stability. Families, remote professionals, and semi-retirees are prioritizing space, security, and a sense of daily rhythm—places where life feels grounded, not transactional.

This trend is fueling sustained growth in Playa del Carmen’s master-planned residential communities. Playacar, the city’s original high-end enclave, continues to set the benchmark, with annual price appreciation hovering around 9–10%. Its mix of beachfront residences, golf-side villas, and low-density condos has made it a perennial favorite for buyers who value walkability, greenery, and long-term value retention.

However, demand is no longer concentrated in Playacar alone. Buyers are increasingly looking north and inland to gated communities that offer larger homes, modern infrastructure, and family-oriented amenities. Mayakoba appeals to luxury buyers seeking resort-level services and privacy, while Selvamar has emerged as a favorite for full-time residents thanks to its balance of space, schools nearby, and strong community life.

Other residential developments such as El Cielo, Valenia, and Selvakoba are also benefiting from this relocation-driven demand. These communities cater to buyers who want room for family life, home offices, green spaces, and a slower, more intentional daily pace—elements that are increasingly valued in a post-pandemic world.

As Playa del Carmen continues to mature, its gated communities are becoming about durable, lifestyle-led ownership. For investors, this translates into lower volatility and stronger long-term appreciation. For end users, it offers something even more valuable: a place to truly settle, belong, and build a life.

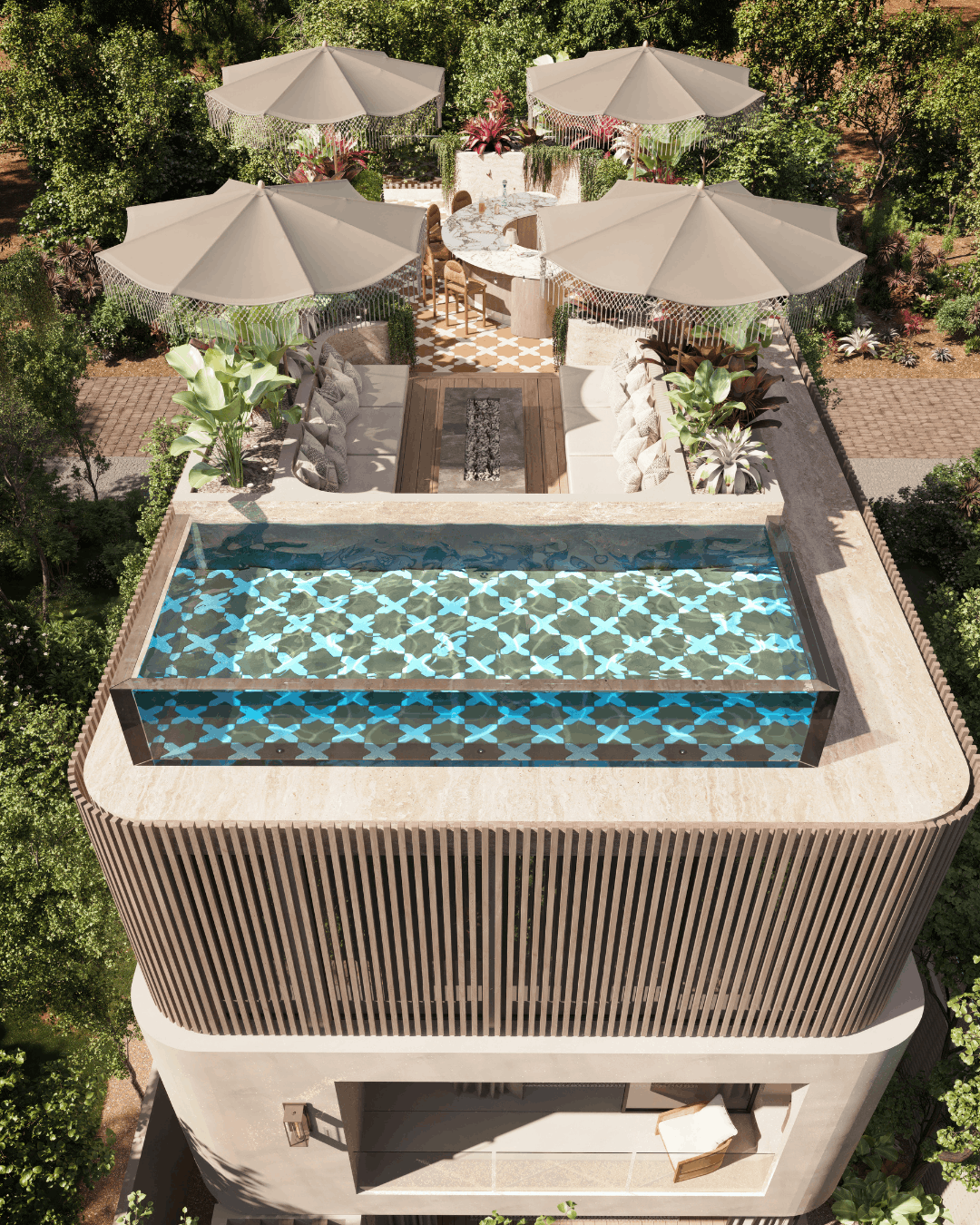

Tulum: resurgence of the villa market

Tulum's property market shows a distinct two-speed dynamic in 2026. While the average home price sits around MXN 5.1 million (roughly $250,000), there's a significant gap between condos (MXN 4.2 million) and villas (MXN 7.1 million). Villas and houses are appreciating at 11-14% annually, substantially outpacing condos due to genuine scarcity of beachfront land.

Aldea Zama, Tankah Bay, and Tulum Centro remain the fastest-appreciating neighborhoods. In particular, Tankah Bay commands price premiums of 30% or more over inland areas as luxury villas attract high-end clientele now arriving through Tulum's new airport.

Risks and Challenges Investors Should Prepare For

Smart investors must carefully evaluate several key risks when considering Riviera Maya real estate in 2026. Understanding these challenges helps create a more resilient investment strategy.

Oversupply in condo-heavy zones

Tulum's real estate market faces significant challenges, with demand experiencing a 40% slowdown caused by oversupply issues. Since 2024, the market has been saturated primarily with one and two-bedroom apartments. This glut has impacted both sales and rentals, with many units remaining vacant or reporting very low turnover. Consequently, rental yields have crashed across most segments except very high-end villas, which still manage net yields around 8%.

In addition to Tulum's situation, other areas with rapid condo development are showing similar signs. Pre-construction units from unproven developers in oversupplied micro-markets represent a substantial risk. Indeed, by 2026, the ultra-luxury segment has cooled from its fever pitch, creating price pressure in some branded developments.

Environmental concerns and beach access

Beach access has become a critical issue affecting tourism and property values throughout Riviera Maya. Governor Mara Lezama acknowledged that limited free beach access has contributed to tourism decline. Although Mexican law guarantees public beaches up to 20 meters from the high tide mark, many beachfront properties effectively control access.

The problem has escalated in areas between Playa del Carmen and Tulum, where gated communities create barriers to beach entry. In some locations like Tulum, beach clubs charge minimum consumption fees of $50-$100 USD, pricing out many visitors and locals.

Regulatory shifts and political uncertainty

Quintana Roo's recent reform of the Ecological Balance Law mandates Environmental Impact Statements for all real estate transactions. This change aims to curb irregular development but creates longer, more complex processes.

Currency fluctuations

Exchange rate fluctuations between the USD and Mexican peso significantly impact real estate investments. Throughout 2023, the peso gained unusual strength against the dollar, marking a departure from historical trends. Looking ahead to 2026, upcoming elections in both Mexico and the USA will likely influence currency patterns.

FIFA World Cup 2026: A Catalyst for Real Estate in Cancun and Beyond

The 2026 FIFA World Cup represents a unique opportunity for Riviera Maya real estate investors, even as matches take place in Mexico City, Guadalajara, and Monterrey. The tournament's influence extends well beyond stadiums, creating ripple effects throughout the Mexican Caribbean.

Projected visitor influx and hotel spillover

Mexico anticipates an additional 5.5 million visitors across the three host cities. Even though Quintana Roo isn't hosting matches directly, few areas will benefit as dramatically from this mega-event. The region's unparalleled resort inventory, direct connectivity to host cities, and global recognition position Cancun, Tulum, and Playa del Carmen as natural second stops after the matches.

FIFA has already confirmed that Moon Palace Cancun and Fairmont Mayakoba in Playa del Carmen will serve as official Team Base Camps, solidifying the Mexican Caribbean as a world-class logistics hub. This prestigious designation acts as a "seal of quality" that attracts serious investors and capital.

Boost to short-term rental income

Hotel rates in Mexico City for the World Cup are already showing increases of up to four times the current average. This adjustment exceeds projected hikes in U.S. and Canadian host cities, where rates are estimated to rise between 55% and 92%.

As a result, approximately 44,000 visitors will opt for short-term rentals during their stay, accounting for more than 274,000 occupied nights and generating a direct economic impact of USD 87 million.

Infrastructure improvements and long-term gains

Alongside the tourism surge, major infrastructure upgrades are underway, including a USD 475 million renovation plan for airport terminals and runways. Additionally, in 2026, a new bridge/causeway will open, creating a connection from downtown Cancun to the Hotel Zone, establishing new hotspots for real estate and shortening travel times.

Ultimately, the World Cup's influence on property values extends well beyond the event itself, with real estate becoming a multi-year investment cycle that begins before kickoff and continues long after the final match.

Outlook for Riviera Maya Real Estate in 2026: Final Thoughts

The Riviera Maya real estate market undoubtedly presents compelling opportunities for investors through 2026.

Location certainly matters within this diverse market. Cancun beach zones benefit tremendously from World Cup visibility, while Puerto Morelos offers exceptional value with its strategic position between major hubs. Meanwhile, gated communities in Playa del Carmen attract relocating families, and Tulum's villa market shows remarkable resilience despite broader market challenges.

Smart investors must nevertheless remain vigilant about potential risks. Oversupplied condo markets, particularly in Tulum, have experienced significant slowdowns. Additionally, environmental regulations, beach access issues, and currency fluctuations all require careful consideration before making investment decisions.

Perhaps most significantly, the upcoming FIFA World Cup stands as a powerful catalyst for property appreciation throughout the region. Although matches will take place elsewhere in Mexico, the ripple effects will reach far beyond host cities. Team Base Camps established in Cancun and Playa del Carmen will attract international attention, while infrastructure improvements will create lasting value long after the tournament concludes.

Considering all factors, Riviera Maya continues to establish itself as one of the Western Hemisphere's most dynamic real estate markets. Therefore, investors who carefully select properties aligned with emerging trends—such as family-sized townhouses and beachfront villas—will likely see strong returns despite potential economic headwinds. The Riviera Maya's enduring appeal, coupled with strategic improvements and global events, suggests this Mexican Caribbean corridor will remain a lucrative investment destination throughout 2026 and beyond.